are funeral expenses tax deductible in ontario

Even the most humble of funerals can come with hefty price tags. None of those expenses is deductible.

Are Funeral Expenses A Tax Deduction In Canada Ictsd Org

The estate itself must also be large enough to accrue tax liability in order to claim the deduction.

. In short these expenses are not eligible to be claimed on a 1040 tax form. The cost of funeral expenses may be deducted from the deduction of funeral costs. This cost is only tax-deductible when paid for by an estate.

For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form. The Canada Revenue Agency CRA has designated that funds held in a prepaid funeral account called an Eligible Funeral Arrangement EFA must be guaranteed to 10000000 and earns tax. Deductible medical expenses may include but are not limited to the following.

June 3 2019 1228 PM. Much like burial and final expense insurance this is not allowed by the IRS however these expenses can be deducted via your estates tax form if you elect to pay for your burial expenses with. No special deductions.

One of the questions that I am asked is whether or not prepaid funeral payments can be deducted on Personal Tax Returns. What Funeral Expenses Are Tax Deductible. No never can funeral expenses be claimed on taxes as a deduction.

They are never deductible if they are paid by an individual taxpayer. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes.

These are personal expenses and cannot be deducted. A casket hearse limousine and floral costs can be deducted from. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases.

While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes the estate of your loved one can take a deduction on these costs. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible. The answer unfortunately is no and heres why.

Can I deduct funeral expenses probate fees or fees to administer the estateNo. Not all estates are large enough to qualify to be taxed. Writing Off Funeral Expenses As Part Of An Estate.

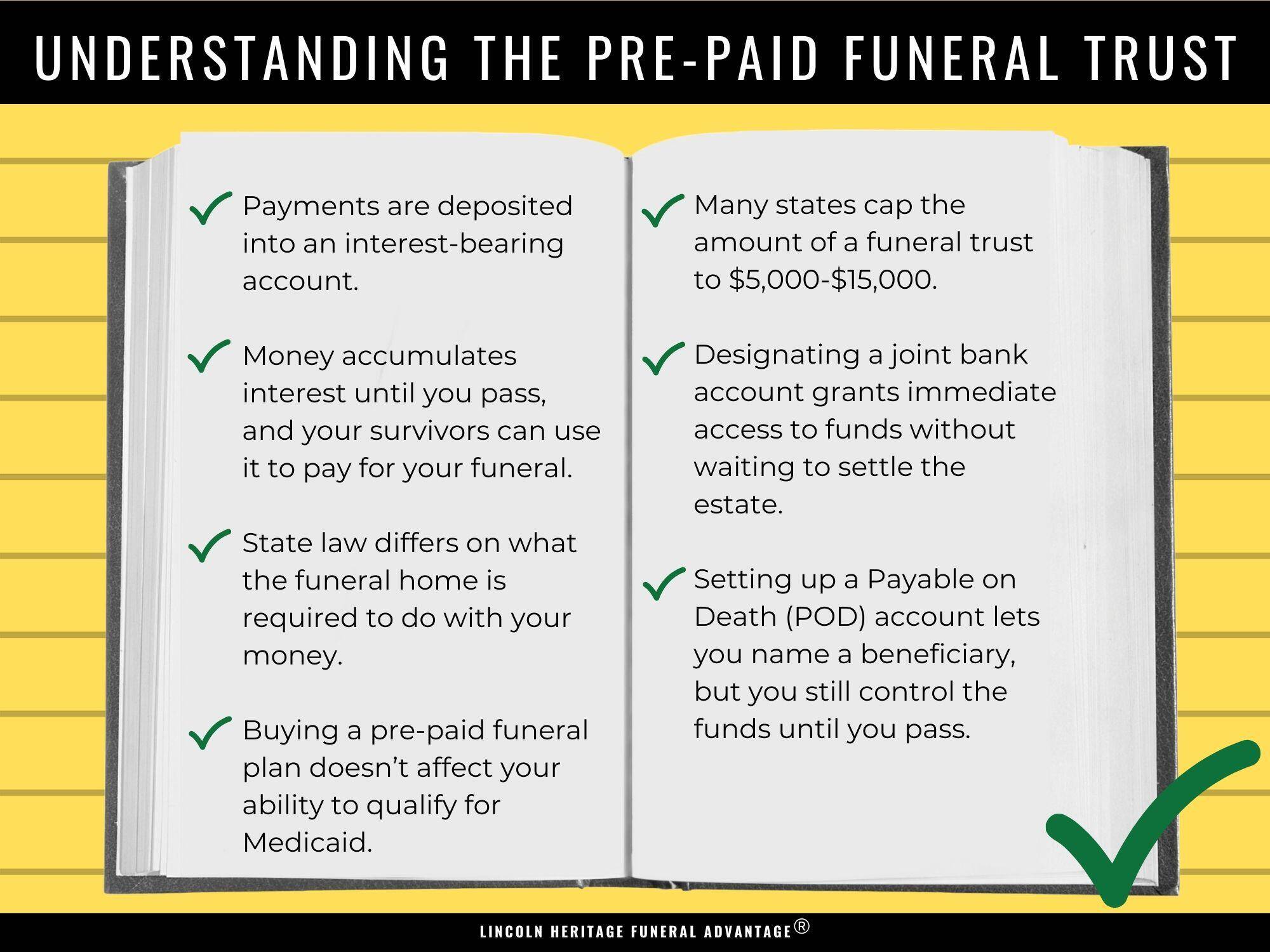

In other words funeral expenses are tax deductible if they are covered by an estate. Paying for a funeral ahead of time means that your money is still being saved for a future need but because it has already been spent you dont have to pay taxes on it. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling.

Funeral expenses are not tax-deductible. So no funeral and cremation expenses are not tax deductible. This means that you cannot deduct the cost of a funeral from your individual tax returns.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Qualified medical expenses must be used to prevent or treat a medical illness or condition. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction.

The estate is on the hook for all funeral expenses probate charges and fees. Individual taxpayers cannot deduct funeral expenses on their tax return. According to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate.

Funeral insurance is not tax-deductible. If the funeral expenses were paid by heirs friends charity initiatives or any source other than the deceased persons estate they do not qualify for any tax deductions. Claiming deductions credits and expenses Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay.

The IRS deducts qualified medical expenses. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. Qualified medical expenses mean it was used to prevent or treat an illness.

You can read more about this issue here. Funeral expenses are not tax deductible because they are not qualified medical expenses. Qualified medical expenses include.

In fact many people find it difficult to cover the cost of a funeral without experiencing at least a minor financial hardship. These are personal expenses and cannot be deducted. While settling an estate you may be able to claim a deduction for funeral expenses if you used.

Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return. Expenses Must Be Reasonable and Necessary. Ask our experts about funeral costs payment plans and government funding programs.

Have a question about funeral costs. Who doesnt qualify for deductions An individual taxpayer is not entitled to. Even though medical costs are allowed funeral costs are not permitted by the IRS.

Funeral Costs Paid by the Estate Are Tax Deductible. Unlike any other expense funeral expenses cant be deducted for income tax purposes whether the money is spent directly by a person or by the estate. Were here to help 247.

Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate. The taxes are not deductible as an individual only as an estate.

While the IRS allows deductions for medical expenses funeral costs are not included. Although funeral expenses arent tax deductible in the traditional sense there are ways to avoid the heavy burden of funeral costs. Can I deduct funeral expenses probate fees or fees to administer the estate.

Determining if Funeral Expenses Can be Tax Deductible. If the deceaseds state is taxable then executors are able to recoup some.

Are Funeral Expenses A Tax Deduction In Canada Ictsd Org

Can You Claim Funeral Or Burial Expenses As A Tax Deduction For 2019 Cake Blog

Are Funeral Expenses Tax Deductible Funeralocity

Are Funeral Expenses Tax Deductible Funeralocity

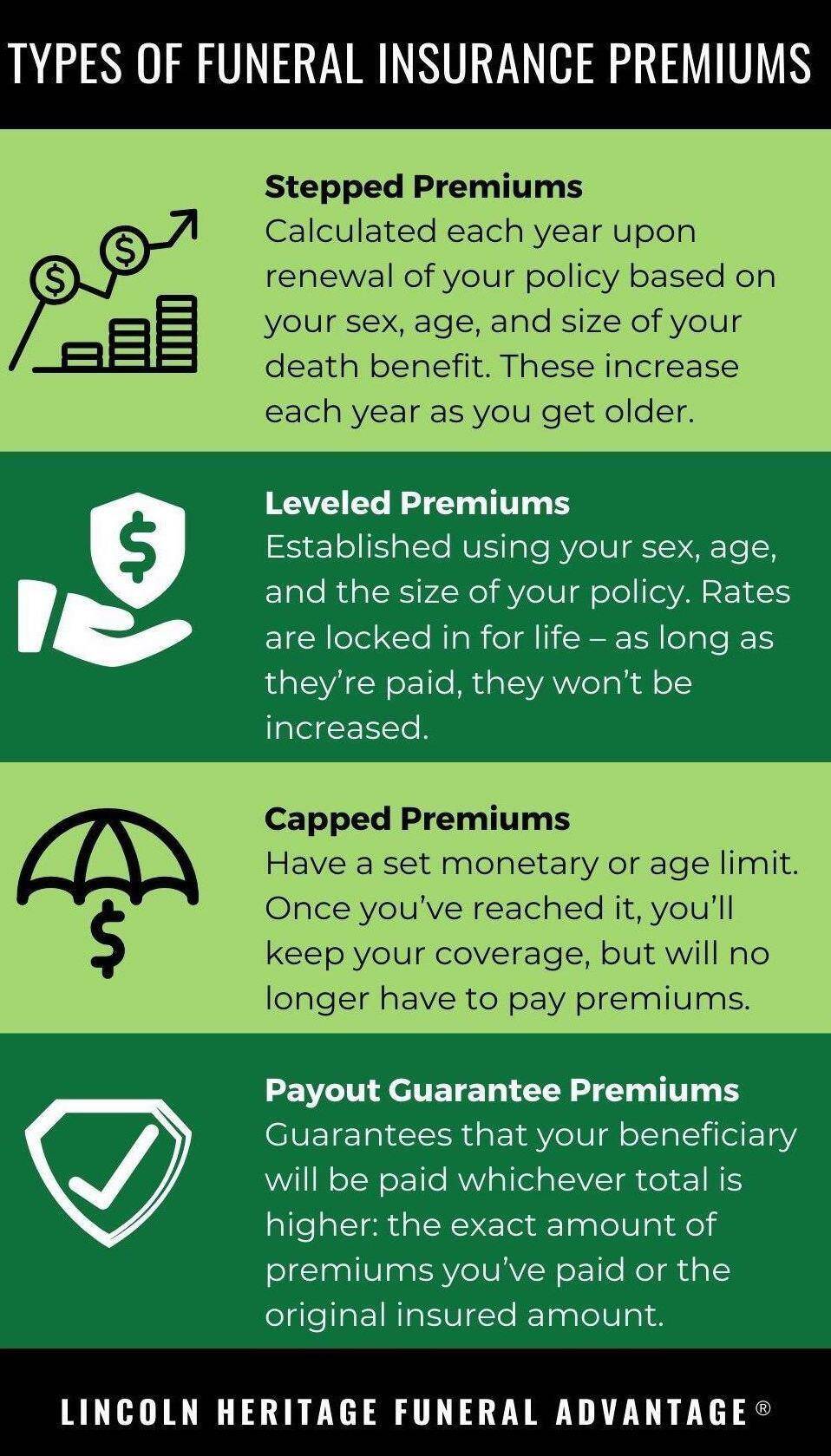

2021 Guide To Funeral And Burial Insurance Lincoln Heritage

Are Funeral Costs Tax Deductible In Canada Ictsd Org

Inspirationalquotes Motivationalquotes Luxurylifestyle Instagramquotes Quoteoftheday Dailyquotes Lifequotes L Luxury Quotes Rich Quotes Thinking Quotes

Does Life Insurance Pay For Funeral Expenses Preplan Funeral

Are Funeral Expenses A Tax Deduction In Canada Ictsd Org

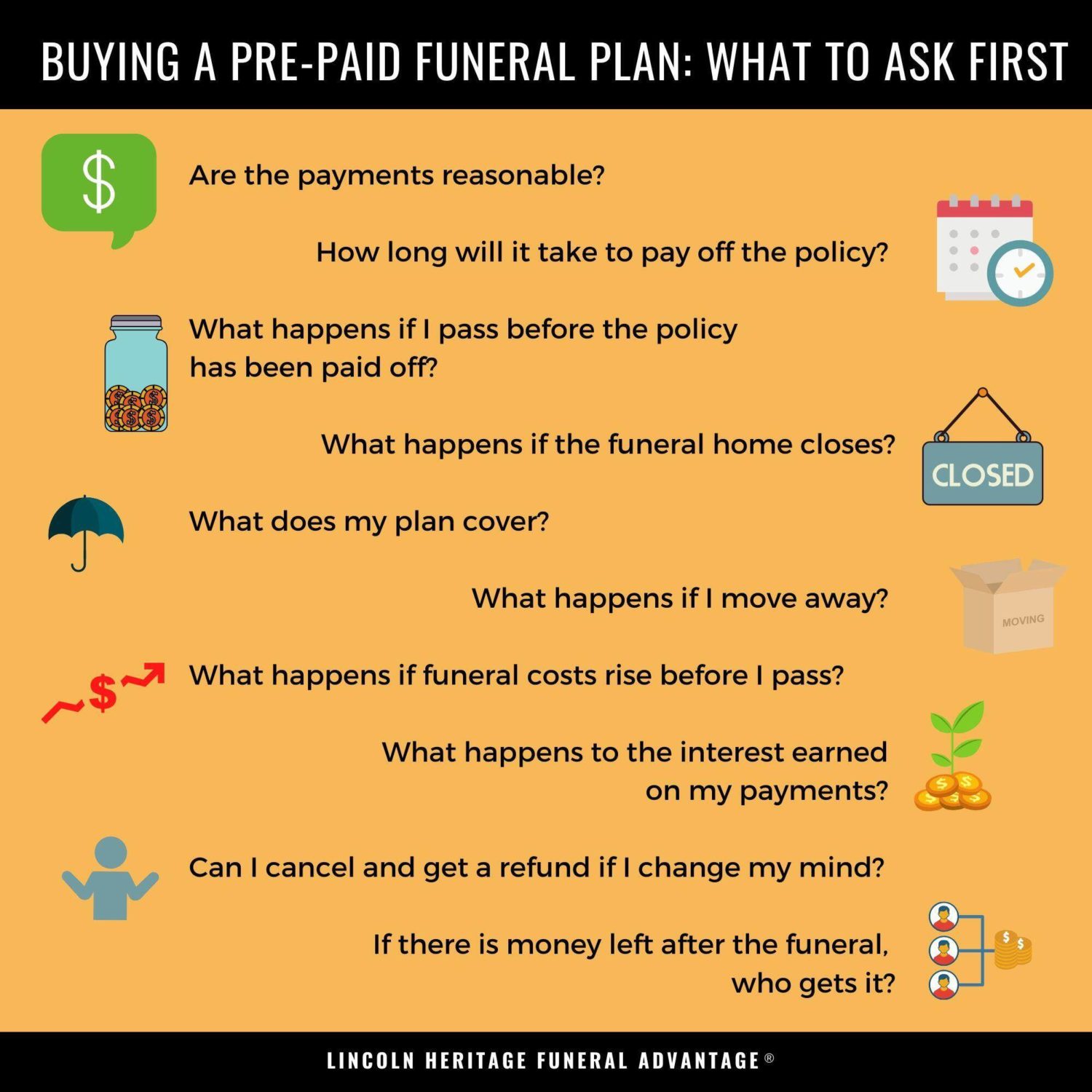

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Are Funeral Costs Tax Deductible In Canada Ictsd Org

3 Reasons You Should Never Prepay Funeral Expenses The Motley Fool

Are Funeral Expenses Tax Deductible Funeralocity

What Government Funeral Assistance Is Available If You Can T Afford End Of Life Expenses In Canada

Funeral Costs Questions And Answers

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Are Funeral Expenses Tax Deductible Funeralocity